Secure

Your Future

Protecting Your Loved Ones with Reliable

Life Insurance Solutions

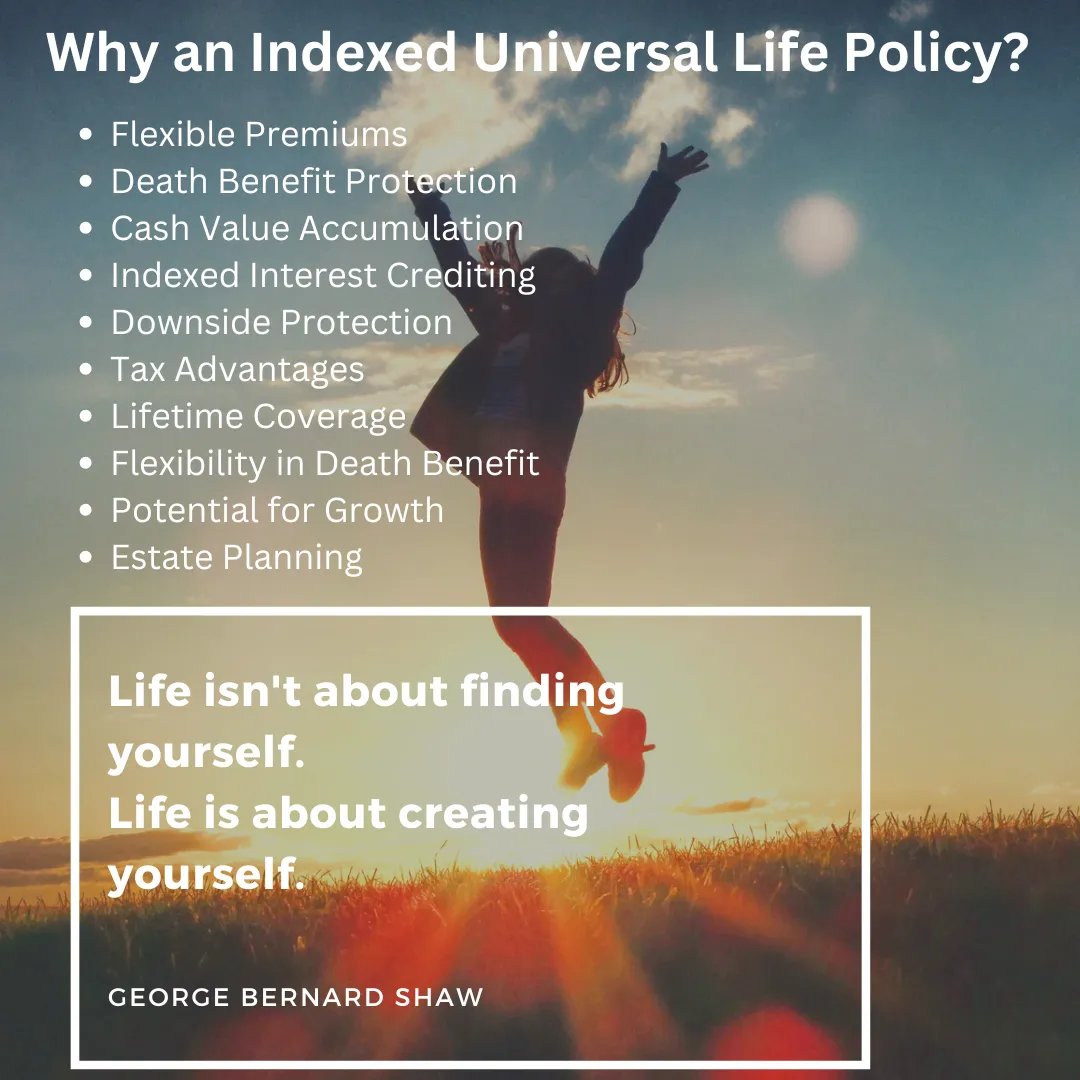

Indexed Universal Life Insurance

Indexed Universal Life Insurance (IUL) is a type of permanent life insurance policy that offers both a death benefit and a cash value component. It allows policyholders to allocate a portion of their premium payments to a fixed account and another portion to an equity index account, typically linked to a stock market index like the S&P 500. The cash value grows based on the performance of the chosen index, subject to caps and floors set by the insurance company. This provides potential for higher returns compared to traditional whole life insurance policies, with downside protection against market downturns. Policyholders have flexibility in premium payments and can adjust the death benefit over time to meet changing needs. Additionally, IUL policies offer tax advantages, as the death benefit is generally income tax-free to beneficiaries, and policyholders can access the cash value through loans or withdrawals on a tax-free basis, as long as the policy remains in force. Overall, indexed universal life insurance combines the death benefit protection of life insurance with the potential for cash value growth linked to the stock market, making it a versatile financial tool for long-term planning.