Secure

Your Future

Protecting Your Loved Ones with Reliable

Life Insurance Solutions

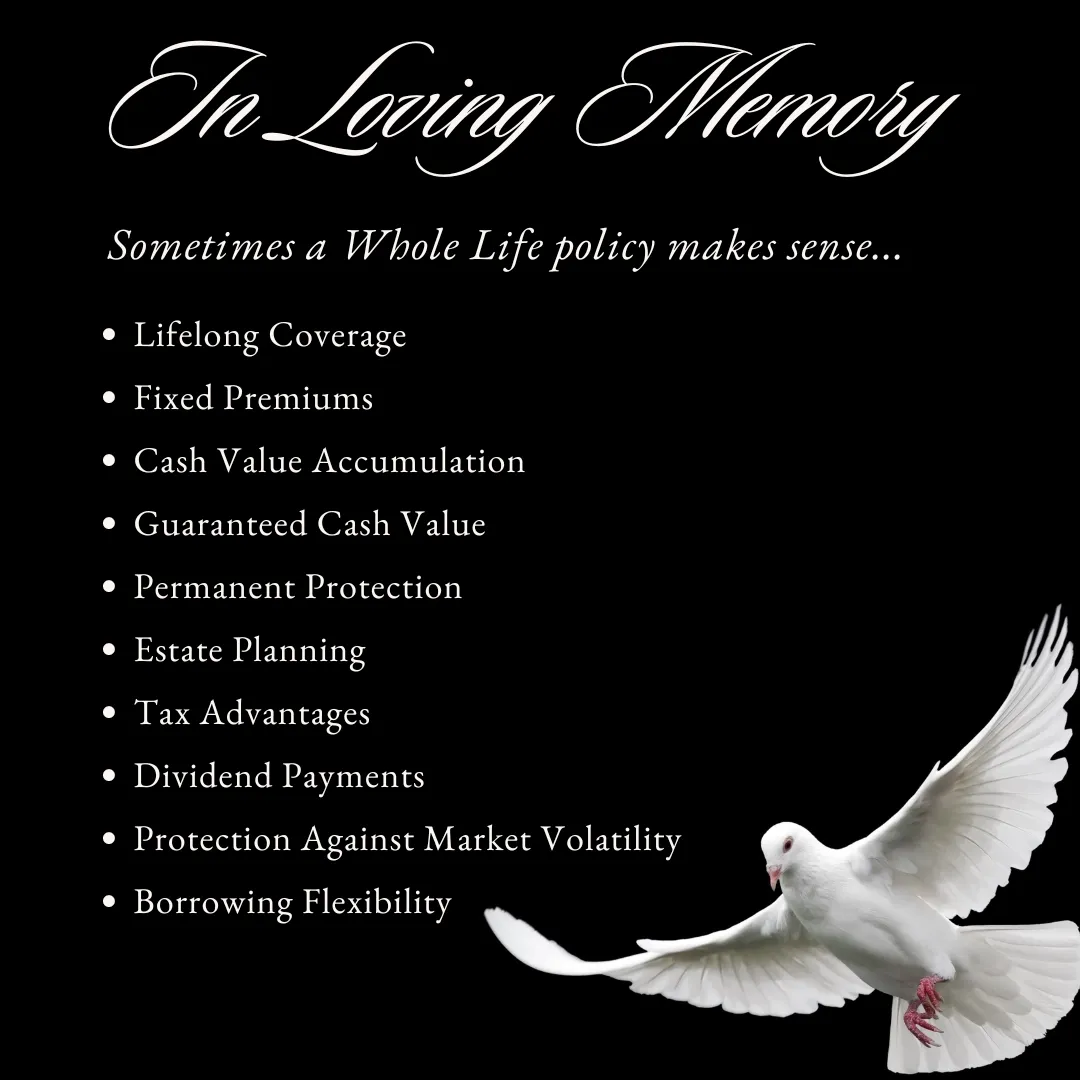

Whole Life

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, as long as premiums are paid. Unlike term life insurance, which covers a specific period, whole life insurance offers lifelong protection. It also includes a cash value component that grows over time, allowing policyholders to accumulate savings on a tax-deferred basis. Whole life insurance premiums are typically higher than term life premiums but remain level throughout the life of the policy. Additionally, policyholders can access the cash value through policy loans or withdrawals, providing financial flexibility. Whole life insurance is often used for long-term financial planning, estate planning, and providing a legacy for heirs.